If you are planning to purchase an apt TDS software then you have landed on the right page. Gen TDS is the country’s one of the best TDS software that provides a simplified and user-friendly interface that is specially designed for filing the TDS returns online considering the rules and the regulations of TRACES and CPC. By using Gen TDS return software which is an innovative tool, one can pre-determine

- The TDS amount,

- Prepare and file TDS returns,

- Calculate interest

- Penalty along with late filing fees — all features available at one destination.

Gen TDS Software is Government Authorized TDS software. Reason Being

- It is listed on the government of India’s official tax information network website.

- Adding further, during the financial year 2012-13, it secured the first rank in the Indian government’s authorized TDS filing software list.

Moreover, professionals can directly log in to the TRACES CPC and NSDL with our TDS return filing software, and so there is no need of generating the User ID every time you log in.

Other significant features such as all India PIN codes, ISD codes, TAN/PAN AO codes, TIN FCs MICR & IFSC codes, service tax ranges, bank BSR codes and so on are inbuilt in the Gen TDS software. The error-free Gen TDS online e-filing software is designed considering the government norms and regulations and makes accurate calculations along with error-free and easy TDS return filing.

It is a comprehensive TDS management software designed and developed with an inbuilt state of the art technology that accelerates the speed of tax calculation along with tax filing while simultaneously following the income tax laws of India. Moreover, it provides a big picture of your firm’s tax workflow

Gen TDS Software Entails the Following Tax Forms

- Error-free TDS/TCS return filing

- Form 16, 12BA, 16A and 27D (TDS/TCS Certificates)

- Form 24Q, 26Q, 27Q and 27EQ (TDS/TCS statements)

- Form 27A and ITNS 281

- New Challan Payment Under TCS Code added

- Form 49B, 13, 15C, 15D, 15G and 15H (Blank formats)

Benefits:

- It is a single entire and solution that matches and meets all tour TDS filing needs along with the authentication of all details at various stages

- It entails an efficient correction module that enables the preparation of correction returns with ease.

- It offers a highly efficient mechanism for managing client information. Apart from robust tools for doing various IT-related calculations, this software is apt for managing the clients’ information.

- Facilitates Auto-Filling: It saves your as well as your clients’ data in the software. You can use it for automatic filling of the entries and work continuously without any pause.

- Multiple Login: Remote working is never a bottleneck with Gen TDS software. Users can have access to their account from multiple devices

- Calculation: Provide the facts and figures of all your clients in real-time for maximizing client-based reporting. Moreover, Your employees also can easily update the data whenever the need arises

- Backups: It designs and builds data backups for all your data and client reports. So, It helps you to introspect and perform better.

- Collaboration: A team of people can collaborate and work simultaneously on a project without hindering each other’s work.

Why You Shall Choose Gen TDS Software Only

- You can have access to a free demo anytime and anywhere.

- We take an input of your requirements and then propose the desirable, viable and apt software solution for you specifically.

- We explain all the features by providing a demo before delivering the software to you.

- Our marketing team is always available to assist you.

- You can have a personalised plan and pricing too as per your requirements.

We possess decades of experience and know all the aspects of Softwares issues that may crop up and accordingly deal with it.

And With the changes in tax laws, we also make changes in our software. So we are updated all the time.

Additional Features in Gen TDS Software

- Preparation of Form 24G in a simple & fast way

- Our software entails all data types – Salary, Non-Salary, Foreign & TCS

- Our Data authentication mechanism eliminates potential errors

- Our software makes it possible for Quick generation of Text & FVU file

- We provide Comprehensive Reports

- We have an inbuilt procedure for making Corrections

- We are capable to handle large data

- We have Prompt Support

- The facility of Auto Software Update

- Our software is apt for the current financial year and earlier ones

How to Prepare TDS Return by Gen TDS Software?

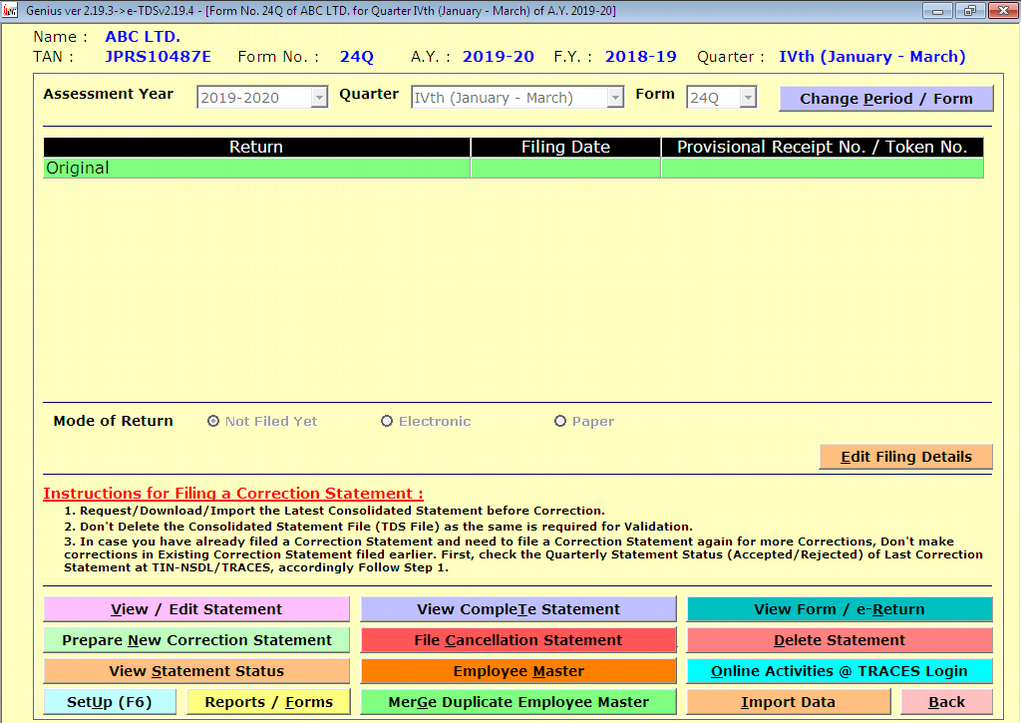

Step-1: The users click on the option of TDS Forms from the above-mentioned list. Thereafter, the users should choose an option to view & edit the statement.

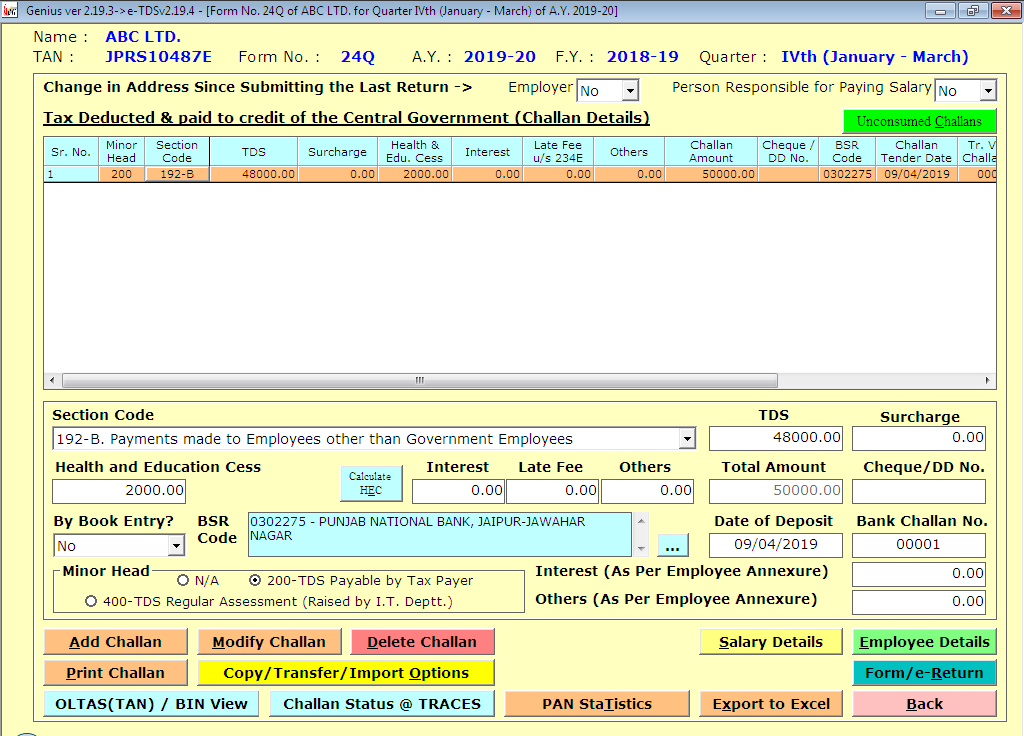

Step-2: In this step, the users should give their details related to the challan by clicking the add challan option. You may also import the unused challans from the traces portal.

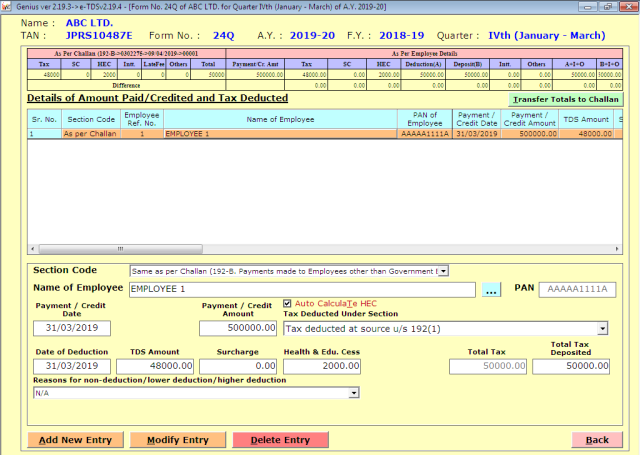

Step-3: The users should provide the employee information which is mentioned on the specific challan by tapping on the “Employee/Deductee information option.

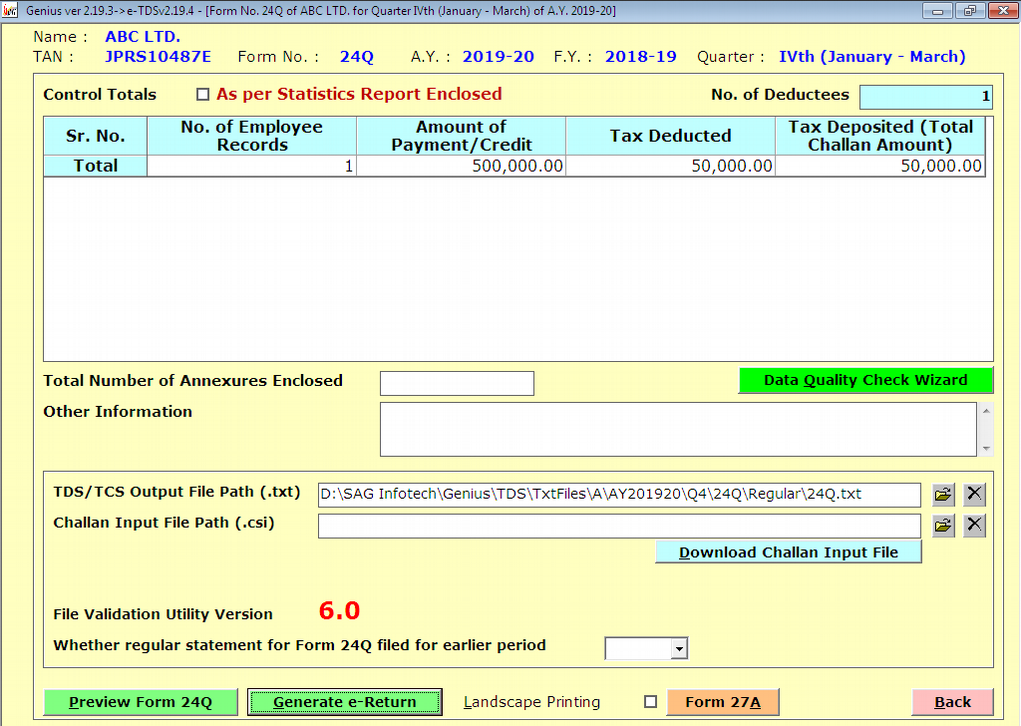

Step-4: When the user has inscribed the details related to the employee then he/she should go back to the main page by tapping on the view form E-return option.

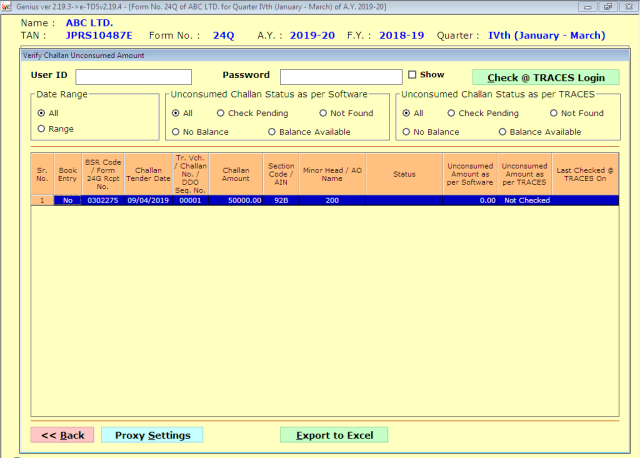

Step-5: Then verify the challan status from the Traces portal, the user should tap on the “generate e-return” option.

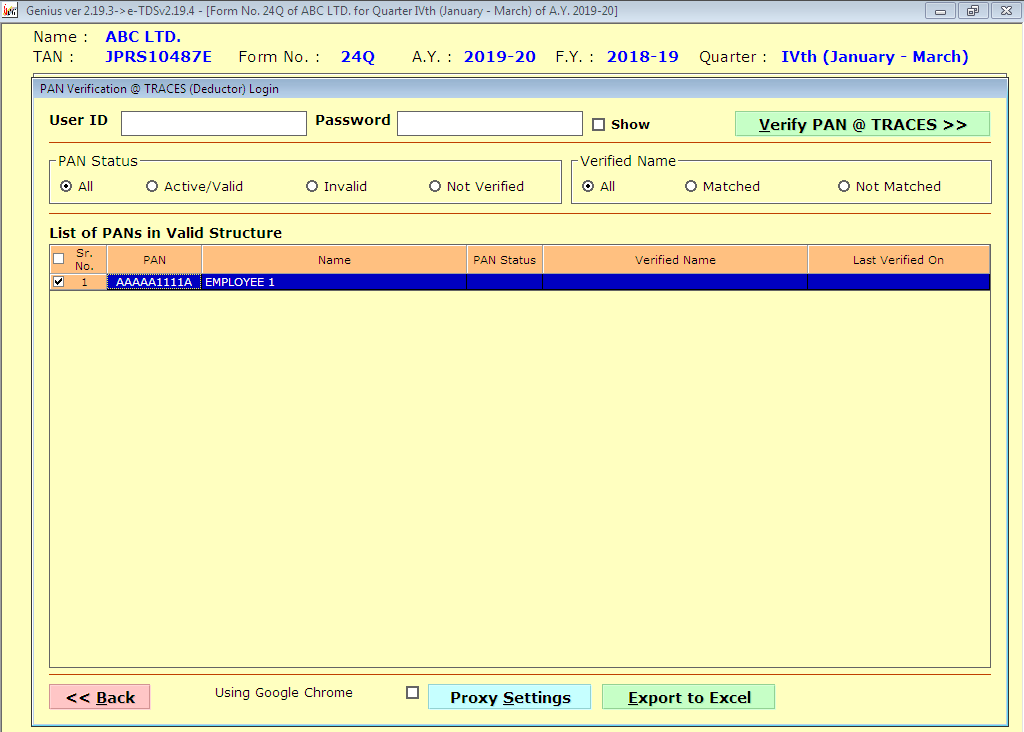

Step-6: The user may verify the PAN status of the deductees from the traces.

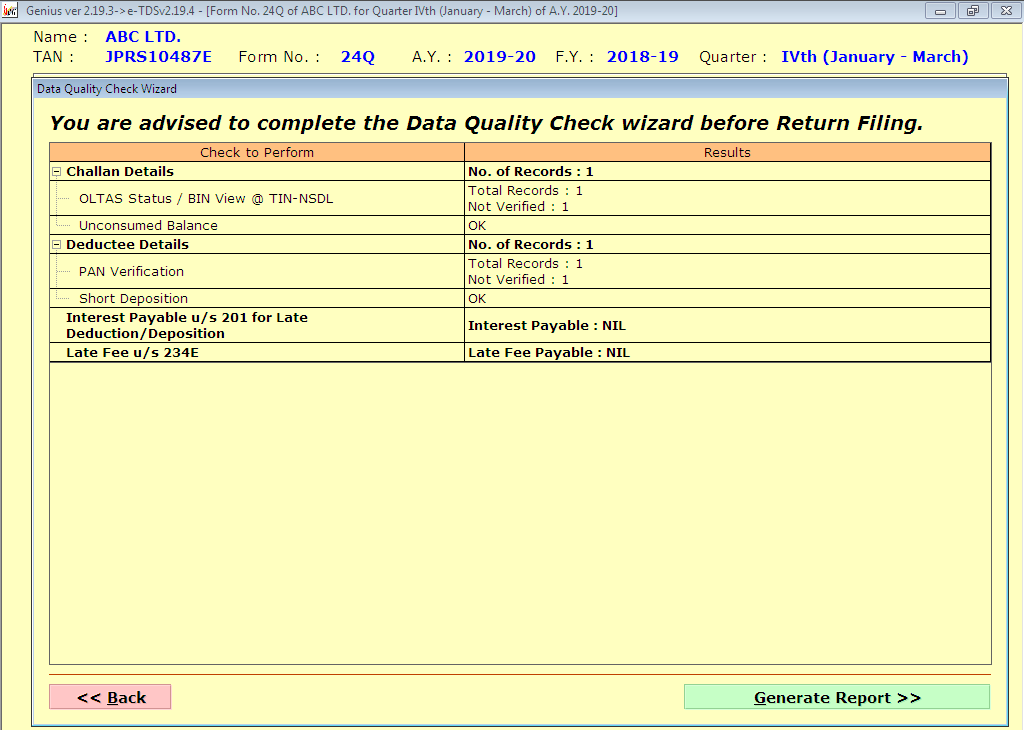

Step-7: Thereafter, The customer will be given a short report as present in the section.

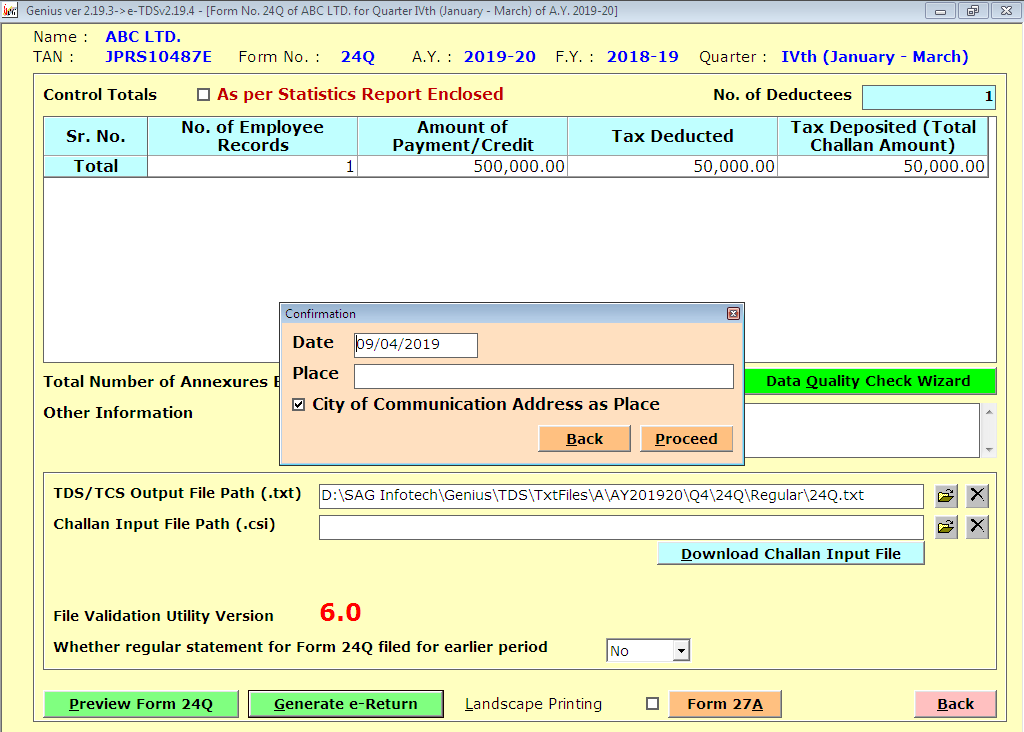

Step-8: In this last step the customer will Tap on the Proceed option as given below and by Tapping on the similar button the Fvu file shall be displayed which may be uploaded by the customer online. The file may also be submitted in a manual way via IN FCs.

FAQs on TDS Return Filing

“Q.1 What is the meaning of TDS?”

“Tax Deducted at Source (TDS) is a tax collection mechanism in India, under the, in which the tax is collected at the very source of income i.e. the point at which the income is generated. Under this system, an individual or deductor who is responsible to make payment of prescribed nature to any other individual or deductee shall deduct tax at source from the deductee’s income and deposit the same into the Central Government’s account on behalf of the deductee. TDS is one of the measures against tax-evasion practices and results in quick and efficient tax collection.”

“Q.2 Who Needs to File TDS/TCS Statements?”

“According to the Income Tax Act, 1961, it is mandatory for all corporate and government deductors and collectors to file their TDS and TCS statements, respectively, in electronic form. However, the same can be filed either manually or electronically if the deductors or collectors are not corporate or government deductors.”

“Q.3 Is it Necessary for Employees and Deductees to Quote their PAN?”

“All the deductees must quote their PAN. However, as far as educators are concerned, it is mandatory only for non-Government deductors.”

“Q.4 What is ‘Bank Branch Code’ and from where it can be Obtained?”

“Bank Branch Code is a unique seven-digit code assigned to each branch of the bank by the Reserve Bank of India. The bank branch code of the bank branch where TDS is deposited needs to be mentioned in the e-TDS/TCS return. Bank Branch Code can be obtained from the bank branch itself”

“Q.5 How TAN is Different from PAN w.r.t Deductor?”

“PAN is an abbreviation of Permanent Account Number whereas TAN is an abbreviation of Tax Deduction Account Number. TAN of deductor i.e. an individual who deducts tax is important to be quoted on the TDS related documents and submitted to the income tax department. So, a deductor must hold a TAN even if he has PAN. However, as per section 194- IA, when a deductor purchases land or building and pays TDS on it, then he need not hold a TAN, he can remit the TDS using PAN.”

“Q.6 How the Returns eTDS & eTCS are Prepared?”

“The returns eTDS and eTCS are prepared in the format prescribed by the e-Filing Administrator which is available on the official website of the Income Tax Department (www.incometaxindia.gov.in) and e-Gov-TIN website of NSDL(www.tin-nsdl.com). The prepared e-TDS/TCS return should be duly validated using File Validation Utility which is available with the data structure. Noteworthy points while filing the e-TDS/TCS return is as follows:”

- “e-TDS/TCS return file should not be stretched to diversified computer media and should be filled in a virus-free CD/Pen Drive”

- “Physical Form No. 27 should be attached to the e-TDS/TCS return file. Form No. 27A should be in physical form and should be properly filled & signed by an authorized signatory”

- “Post-February 1, 2014, Submission of Form 27A created using File Validation Utility becomes mandatory”

- “Overwriting or striking should be avoided on Form No. 27A”

- “An e-TDS return file should be compressed (when it needs to be compressed) through Winzip 8.1 or ZipItFast 3.0 compression utility or higher version for the smooth & quick filing of return”

- “Any bank challan or copy of the TDS/TCS certificate need not be filed with e-TDS/TCS return”

- “E-TDS/TCS return may get rejected at TIN-FCs if these compliances are not adhered to”

It is worthwhile mentioning here that SAG Infotech Private Limited company provides a free trial of Gen TDS software for TDS/TCS e-filing. Immediately file your TDS return on time with no error by choosing & using the software of Gen TDS filing.